The digital economy is transforming industries, creating trillions in value around the globe, and reshaping the way we live and work. Tech giants like Google, Amazon, and Facebook are amassing unprecedented wealth, but governments around the world are now demanding their share. As traditional tax structures struggle to keep up, a wave of digital services taxes has emerged, aiming to capture revenue from the booming online marketplace.

In this article, we break down the new Digital Service Tax Act for Canadian advertisers—who is eligible, how to pay, and how it compares to similar taxes worldwide.

New Tax for Canadian Advertisers

If your business relies on Google Ads to attract new customers in Canada, there is an important new rule affecting all advertisers.

Starting October 1, 2024, Google Ads began charging advertisers a new 2.5% surcharge for their ads served across the country. Google is calling this the “Canada DST Fee”, which is being passed along to advertisers as a direct response to the Canadian government’s digital services tax legislation.

The Digital Services Tax Act

Announced in the 2020 Fall Economic Statement, the Digital Services Tax Act is the federal government’s attempt at addressing the tax challenges arising from the modern digital economy.

The Digital Services Tax (DST) requires foreign and domestic large businesses to pay a tax of 3% on revenue earned from services that rely on Canadian user data, or the sale/licensing of Canadian user data. This includes online marketplaces, online advertising, and social media.

This tax is only applicable to businesses that make money on the internet and exceed either $10 million in local revenue or $750 million globally. So most small businesses would not need to worry about the tax. But unfortunately, Google is passing along 80% of that new 3% tax to all Canadian advertisers in the form of a 2.5% Canada DST Fee.

Addressing the tax challenges of our modern economy could be best suited for international cooperation, which is why 137 countries agreed on a two-pillar plan for international tax reform in late 2021. Endorsed by G20 leaders and finance ministers, the international community is working hard to bring the multilateral agreement to fruition. Until a global solution is finalized, the DST serves as an interim measure to ensure Canada captures tax revenue from digital services.

Paying the Canada DST Fee

Since October 1, 2024, advertisers will have noticed a “Canada DST Fee” surcharge on their Google Ads invoices or statements for ads served in Canada. The surcharge is shown as a separate line item. You can also find this charge in the ‘Transaction’ section of your Google Ads account. Any other taxes that apply in your home province, such as sales tax, may also apply to the new fee.

If you’re like most small businesses that use Google Ads, you likely pay via monthly invoicing and automatic payments of roughly your monthly budget. If so, these surcharges will be added on top of your account budget. That means if your monthly budget is $1000 and you spend all $1000 in Canada, you’ll accrue $25 in Canada DST Fees. That will bring your total bill to $1025.00 plus GST or any other applicable tax.

If you pay your Google Ads bill manually, these surcharges may be charged after your payment has been fully spent. That means you could be left with a balance, which will automatically get deducted from your next payment. For example, if you accumulate $25.00 of Canada DST Fee for your ads served in Canada, and you only pay your monthly budget of $1000, only $975.00 would be spent on advertising.

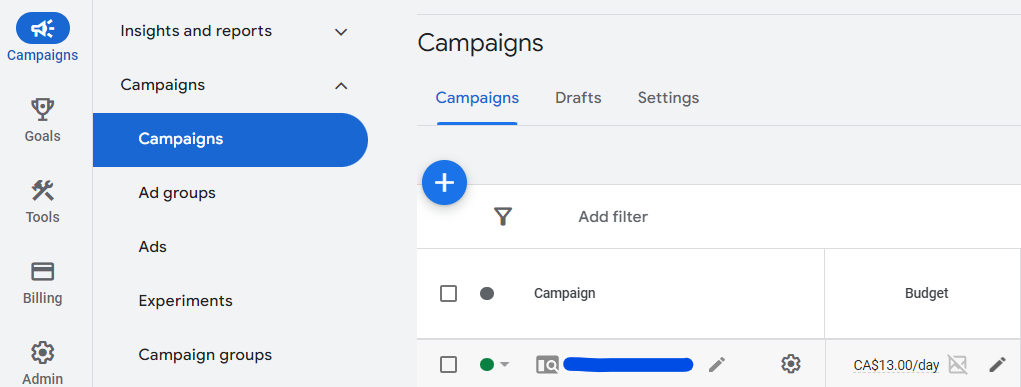

If you’d like to adjust your budget to account for this new tax, either contact your Google Ads manager or do it yourself with a couple of simple steps. Once you’re logged into Google Ads, navigate to ‘Campaigns’ via the main menu. Once you see your campaign, click the little pencil icon under the ‘Budget’ column to edit.

What if We’re Not Canadian?

This new tax is charged to all advertisers who serve their ads in Canada. It’s important to note that even if you’re an American business serving ads in the USA, it’s possible to attract impressions and clicks in Google Ads, and therefore the new Canada DST Fee.

To avoid this, you’ll have to laser-focus your target settings and set up specific location exclusions for the Canadian market. To get help with these settings and avoid this fee as a non-Canadian business, contact a Caorda Google Ads specialist.

Fees for Non-Canadian Advertisers

Canada isn’t the only country affected by taxes and surcharges. In fact, many foreign governments have been much stricter on digital service providers like Google, and as a result, higher fees have been passed along to their advertisers.

European governments have been leading the charge when it comes to taxation of the digital economy. The Turkish government announced a 7.5% DST in 2022, the steepest of its kind. Not long after, Google implemented a 7% Turkey Regulatory Operating Cost to all invoices for ads served in the country. Austria was one of the first to act, and Google retaliated with a 5% Austria DST Fee in 2020. Since then, countries around the world have followed suit, including India, EU nations, the United Kingdom, and Canada.

Contact Caorda’s digital marketing team and Google Ads specialists to inquire about this new tax, fine-tune your target locations, or update your budget.